Niagara Falls Market Overview

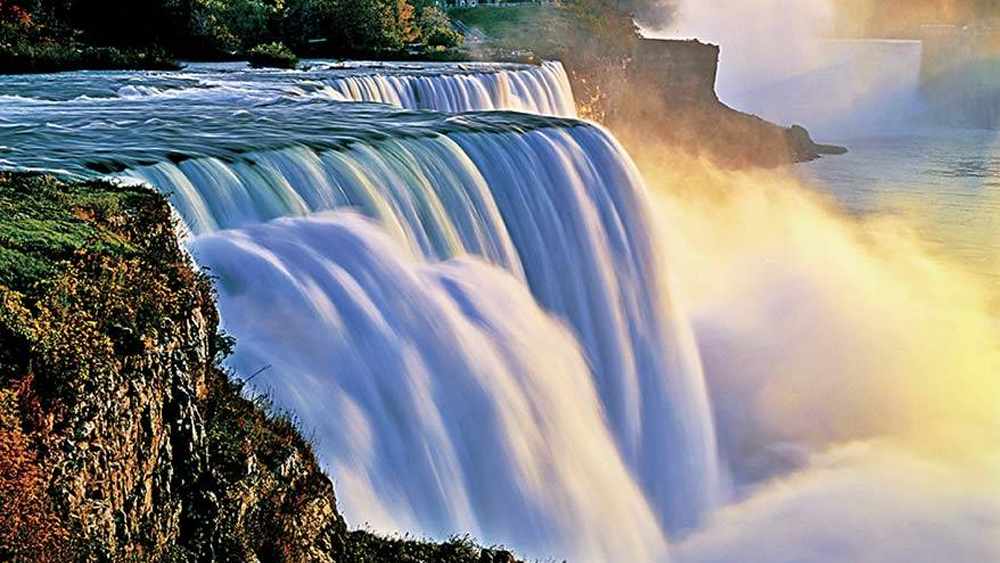

The City of Niagara Falls is world-renowned for the three massive waterfalls and other tourist attractions. Queen Elizabeth Way, acts as a major artery between Toronto and Buffalo, New York.

Niagara Falls has a population of approximately 88,071. The tourist promenade is intense at the edge of the falls. Apart from the natural attractions, the City includes observation towers, high-rise hotels, souvenir shops, casinos, and theatres. Niagara Falls is also home to post-secondary institutions Brock University, Ryerson University and Niagara College, and several private training facilities.

The tourism industry primarily drives the local economy, with over a third of the occupational workforce. Other significant industries include manufacturing, construction, health care and social services, as well as utilities.

The introduction of legal gambling in the mid-’90s has helped the local economy with the gain of tourism and several high-end hotels. Niagara Falls has recently redeveloped Queen street in the downtown core, which included a playground, artificial turf, more public benches, as well as sculptures

Market conditions for multi-family properties in Southern Ontario have continued to strengthen. Although capitalization rates have on average only compressed slightly, rents have increased approximately 6.7% year over year, while rents for purpose-built rental projects within the GTA increased 14% over rates achieved in Q4-2017 according to Urbanisation.

Furthermore, unit turnover rates have sharply decreased to 11.2% in 2018 from 14.5% in 2017(Canada Mortgage and Housing Corporation). This increase in the number of tenants remaining in the same unit is due to multiple factors. Increasing market rents, limited supply of available units, expanded rent control and continually growing barriers to homeownership due to appreciating purchase prices, and stricter mortgage qualification rules drive the rental market.

Over the last year, the trend of historically low capitalization rates has continued with a growing number of transactions reporting rates between 2.75% and 3.25%. A significant driving factor for these transactions has been operators seeking to increase the existing scale.

Overall, the multi-family asset class continues to be one of the most stable, predictable, and financeable commercial real estate asset types in the market. In the foreseeable future, capitalization rates will continue to compress if only slightly, rents will continue to increase more moderately, and vacancy rates will remain at historically low levels.